Quick history of qualitative

In-person marketing research traces its origins back to the 1940s. Spearheaded by such legends as sociologist Robert King Merton and psychologist Ernest Dichter, the value of qualitative research was firmly established when insights gleaned from focus groups drove unprecedented sales for brands such as the Chrysler Plymouth, Ivory and Betty Crocker. Consequently, to this day qualitative research is still regarded by many a marketer as the gold standard for understanding the customer experience because it’s the only credible tool for surfacing sensory nuance, revealing cognitive decision making and answering the deceptively hard question “Why?” Yet, frustratingly, the fundamental mechanics of the process have remained unchanged for nearly 80 years. From start to finish, the current status quo process for qualitative still takes on average 6-8 weeks -- a frustrating reality that’s tarnished its appeal, especially for many of today’s young, fast-moving brands.

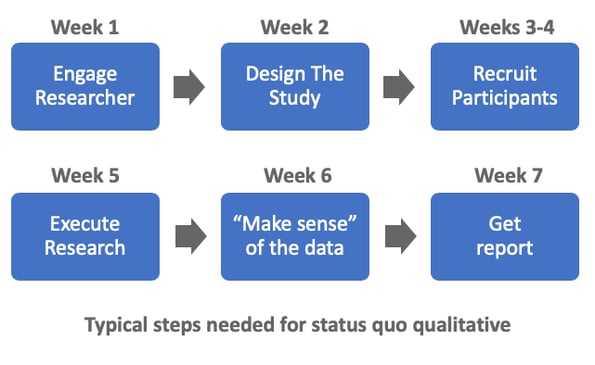

The current qualitative process

Let’s briefly look at the status quo steps commonly needed for qualitative:

- Engage Researcher - Some brands have this capability in-house but many need to engage an outside consultancy to facilitate the research. Optimally, this step is finished in a week but when needing to vet, screen and sign a new vendor partner, this step can itself take weeks.

- Design the Study – What’s the business objective? What questions will be asked of the participants? What’s the demographic profile of the participants? What psychographic, behavioral questions, open-ended questions will be asked? How will facilitator bias be minimized?

- Recruit Participants – If the research requires understanding current customer thinking, a fast path is to invite participation from the brand’s followers on social media or from the brand's own consumer panel. However, often the research necessitates also engaging a portion of consumers with little to no brand exposure or experience. In such cases, this task typically falls to a sub-contracted agency who must then find, recruit, screen and schedule all the participants. This can result in additional weeks of delay. In either case, if the research involves measuring sensory, experiential or tactile aspects of the brand then the decision must be made whether to conduct the research at a physical location or to in some way get physical products/samples to the participants. If the former is chosen, it introduces the 1st significant shortcoming -- regional bias, as only local participants can be engaged at the local physical location (often referred to as the Central Location Test or CLT) in order to minimize travel cost and burden. If the latter is chosen, remote video interviews or video group sessions are often done but additional delay and complication is incurred with packing and shipping out the packages containing the physical assets (with time-sensitive perishable items compounding the challenge) and / or asking the participants to go out and shop various products. Consequently, due to the considerable time, logistical complexity and cumbersomeness in finding participants who match the target criteria, who screen successfully, who have the flexibility to leave their work or participate via video during their work day, on X date, during time Y and who deem it all worthwhile enough to receive compensation Z — the net number of participants ends up being frustratingly few and this introduces the 2nd significant shortcoming: small sample size bias. Specifically, for one-on-one interviews the average participant pool size ends up being on average just 10 and for focus groups just 30.

- Execute Research – Often the 3rd significant shortcoming enters at this stage – group bias. Ideally, each participant would be interviewed one-on-one but, often, due to time constraints some or all of the research is done in a group setting. Here, “group think” becomes a major risk if one of the participants is more outspoken and persuades members of the group to think differently than they would otherwise on their own.

- Make Sense of the Data – After the research sessions have concluded, the research facilitator faces the brutal task of needing to wade through all their notes and video recordings to try and give some structure to a ton of messy, open-ended data. This task is a manual one requiring herculean effort and incurring lots of additional time. Further still, the 4th significant shortcoming enters at this stage – facilitator bias. The very act of having one person wrap their arms around all the data subjects the data to both explicit and implicitly biases, despite best of intentions by the facilitator.

- Get Report – At long last a long report is produced that summarizes key findings and makes recommendations on what to change / do next and why. However, due to the static way in which qualitative reports are generated, there isn’t the ability to dynamically filter all the findings by say just urban millennials. And if the brand wants to iterate on the learnings by executing follow on research with the same (or similar group), this painful process must be repeated.

Pros of current qualitative

Still, despite the shortcomings, the depth-of-understanding and the credibility offered by qualitative can prove highly valuable to businesses:

- Grow revenue - Understanding consumers’ real-world experiences with a product or service and why they would or would not repurchase or why they would still keep buying competitor offerings is vital for any business to attract new customers and retain existing ones. Qualitative questions also provide deep visibility into customers’ anticipated experience vs experience realities. Understanding this divide early on can often mean the difference between having one time buyers and brand loyal repeat purchasers. Further, customer sharing of actual real world experiences with a brand can reveal invaluable in situ contexts and stories that can be used to inject fresh, authentic messaging into a marketing platform or seasonal ad campaign.

- Reduce risk and cost - The human decision-making process is often a fuzzy one because most of the time we’re not encountering ‘apples to apples’ choices. Consequently, engaging consumers in sharing their honest, open-ended feedback during concept and product development can provide one of the best means to surface unexpected purchase deterrents for a given target demographic or to understand the decision making tradeoffs consumers will make when presented with choices that vary by messaging, claims, price, etc. This approach can thus help to increase the odds of success when launching new products or line extensions and reduce the risk that the significant capital expenditure required to bring new offerings to market ends up being a formidable loss.

- Gain channel distribution - Measuring how and why consumers purchase at the SKU vs SKU level (e.g. which brand, A or B, would you buy again and why?) when every data point is trusted because it's verified and guaranteed to be a real person’s voice is invaluable. You come out ahead either way: If the data is less than flattering it makes clear what needs to be done and why in order to convert passives (“I would buy but…”) into promoters. Conversely, if the data is highly flattering the combination of qualitative credibility and quantitative rigor (e.g. participants matching a retail buyer’s own shopper demographics) can help bring compelling and persuasive proof points to win over that retail buyer.

Cons of current qualitative

Despite the benefits, the current shortcomings must be understood clearly:

- Flawed Conclusions – despite best efforts during participant recruitment, the insights gleaned from in-person research risk fundamental bias because the sample size is too small or too regionally constrained or both. The negative consequences to your business could be significant -- from incorrectly concluding that the opinions of those in one region accurately reflect the thinking of those nationwide -- to extrapolating that the opinions of only a couple dozen accurately reflect the broader target demographic. Flawed conclusions are no doubt major contributing factors to the notoriously high failure rate of new products.

- Lost Revenue – Companies carrying out qualitative research might gain crucial market insights but they risk enormous opportunity cost. If it takes a month and a half to get answers to business questions needed to inform a product’s launch, that’s potentially a month and a half of lost revenue had the product been launched without delay. Or, worse, it could result in giving first-mover advantage to a competitor who secures key channel partner distribution because their product was ready and yours wasn’t.

Ideal qualitative for your business

As can be seen, for nearly 80 years in-person qualitative has been a double edge sword offering the potential for invaluable insights but with significant shortcomings. So what does ideal qualitative look like?

- First, you would have the capability to instantly engage consumers anywhere (or everywhere) in the country, completely eliminating regional bias.

- Second, you would be able to ask the same open-ended questions as you would in the same room. And, more importantly, they, in turn, would be able to respond to you in that most natural and authentic of human capabilities – simply by speaking.

- Third, you would be able to easily blend quantitative with the qualitative thereby creating a seamless experience for the participant wherein, for instance, you might ask them to rank order several options (i.e. quant), then explain their reasoning (i.e. qual), then respond to price sensitivity (i.e. qual) and finally voice their preferred choice (i.e. qual).

- Fourth, you would be able to create hybrid online/real-world experiences that accurately reflect the reality of how today’s consumers gather and process information in their decision-making journey. This could take the form of initial brand discovery (e.g. watching a video), then engaging a virtual shelf of offerings (e.g. shopping online) and finally physically experiencing the brand in situ (i.e. using it at home).

- Fifth, you would be able to rapidly execute any qualitative test with just the push of a button and receive back 100% credible insights in a fraction of the time. Consequently, you would eliminate the risk of lost revenue by obviating the need for a month and a half of delay. Further, you would have the opportunity to enter the market with the confidence of knowing you’ve maximized the potential for customer engagement because you would have iterated on multiple qualitative tests, quickly retargeting the same pool with follow on questions that build upon learnings from previous tests. The execution of rapid iterative in-person retargeting is of course time prohibitive with current methods.

- Sixth, you would be able to instantly visualize the qualitative data by both sentiment (i.e. how it was said emotionally) and content (i.e. what was said contextually). Additionally, you would be able to dynamically filter the qualitative data as you’re accustomed to doing with quantitative data. For example, if you wanted to compare and contrast the qualitative insights of Gen Z males with prior brand experience to those without, you would be able to tap a button and have all the data -- both closed ended responses AND open ended responses -- instantly filtered. Finally, you would be able to easily zero in on a particular segment, for example Gen X passives who are all talking about a certain product claim, tapping to instantly replay what they said in order to hear and understand their decision making process.

About Qbit

I founded Qbit five year ago out of Silicon Valley along with my business partner Ravi Dwivedula. We previously held leadership roles at the Neat Company where we were deeply involved with understanding users' experiences with the company’s consumer and business products. Qbit was born out of our repeated frustrations with slow, cumbersome and costly in-person research. Since then Qbit has been granted multiple patents for its technologies with additional patents pending.

Our mission at Qbit is to help brands grow market share by providing the fastest and most credible way to understand consumer decision-making. Trusted by national brands and public companies, Qbit has crunched millions of spoken words by consumers about their experiences with hundreds of brands. By capturing real-time experiences via audio or video, Qbit ensures 100% authenticity and verifiability. Qbit’s Android and iOS apps empower brands to engage consumers anywhere (virtually, in-store, at home, etc.) and at any point along the customer journey. Qbit's AI rapidly crunches open-ended data into crisp actionable insights based on both context and sentiment, empowering brands to get fast feedback to any business question.